What is a sales tax exemption in Magento 2?

A sales tax exemption in Magentocertifies a business or organization to make purchases tax-free on orders that would otherwise be subject to tax. Here are some examples in which sales tax is waived:

- A tax-exempt organization, such as the Girl Scouts, making purchases for their events

- Retail businesses generally would not have to pay sales tax when buying wholesale items that will be resold to an end-user. The reason for this is because the end-users are already required to pay the sales tax when they make the purchase.

Instructions

-

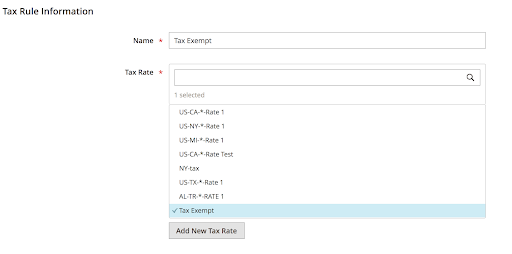

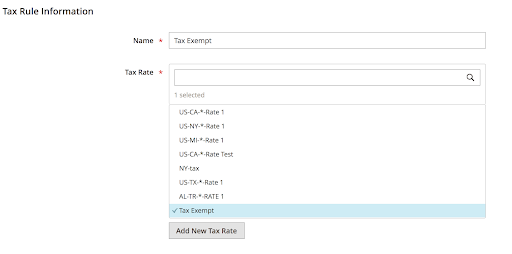

Create a tax rule

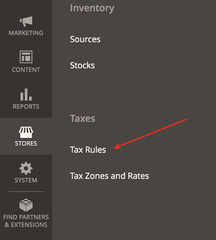

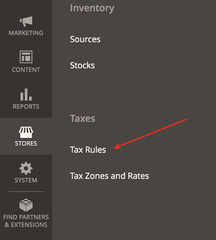

a. Navigate to Stores > Taxes > Tax Rules

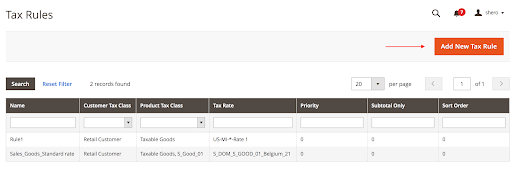

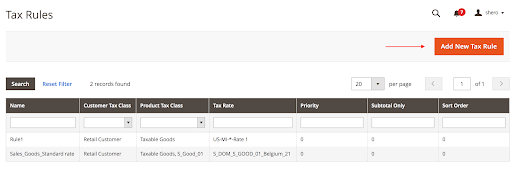

b. Click on “Add New Tax Rule”

c. Name: Tax Exempt.

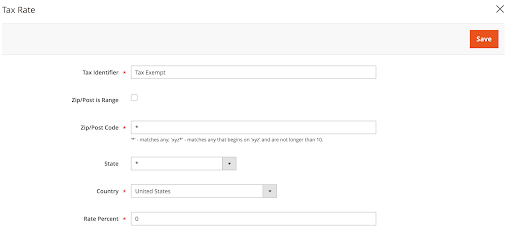

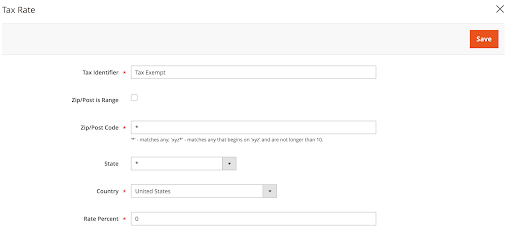

d. Tax Rate: Select “Add New Tax Rate”

e. Create a new Tax Rate for Tax Exempt.

1. This rate will be for all states in the United States. If Tax Exempt is used in other countries, additional rates will need to be added.

f. Save the Rate.

g. Select Tax Exempt under Tax Rate.

h. Next, go toAdditional Settings.

i. You will need to create a new Customer Tax Class.

j. Click on Add New Tax Class

k. Type in Tax Exempt and click the checkbox.

l. Now select Tax Exempt under Customer Tax Class.

m. Save the Rule.

-

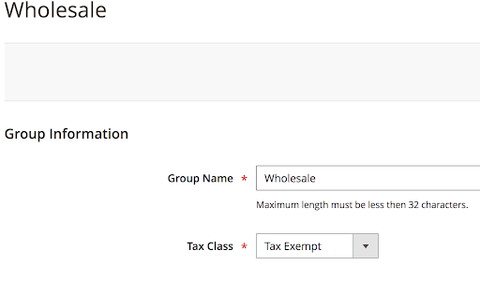

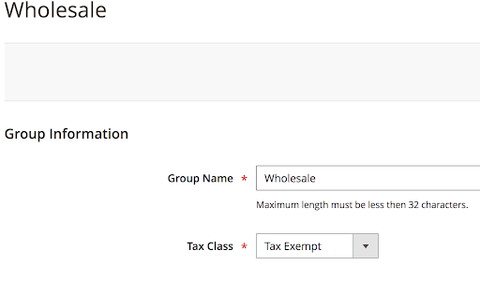

Assign the new customer tax class to a specific customer group.

a. After the rule is created, you will want to assign this Customer Tax Group to a Customer Group. We will use Wholesale as an example.

b. Navigation to Customers > Customer Groups

c. Select the Wholesale Customer Group and change the Tax Class to Tax Exempt:

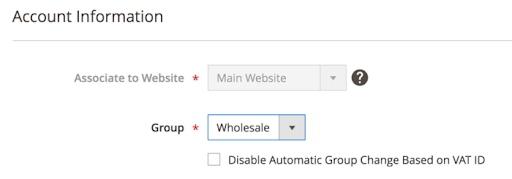

- Assign customers to the customer group

Additional Steps To Test the Rule:

-

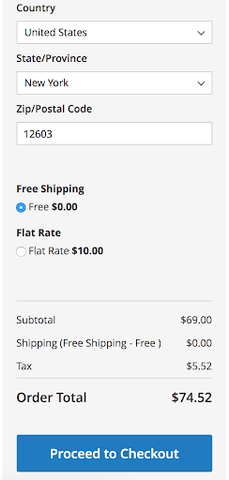

Testing the rule

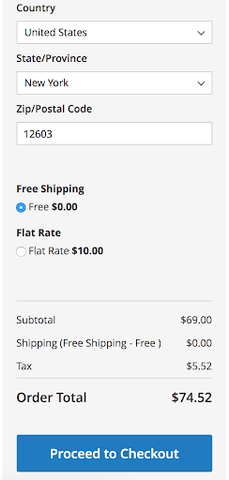

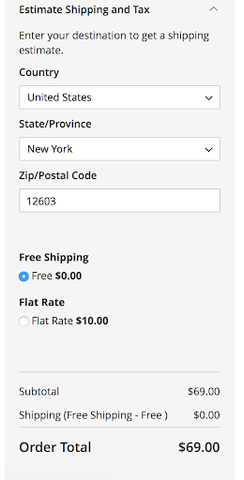

a. You will want to test the rule to ensure it works properly.

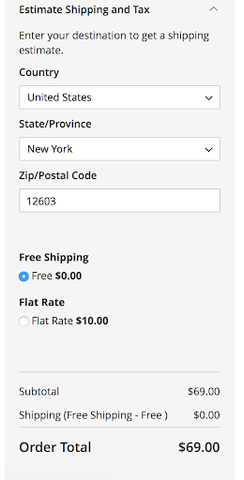

b. Test an order as a Guest.

c. Log in to the wholesale account where the customer is tax exempt and confirm tax is not collected.